India gambles on Chinese technology to keep its transition from electric vehicles on the right track.

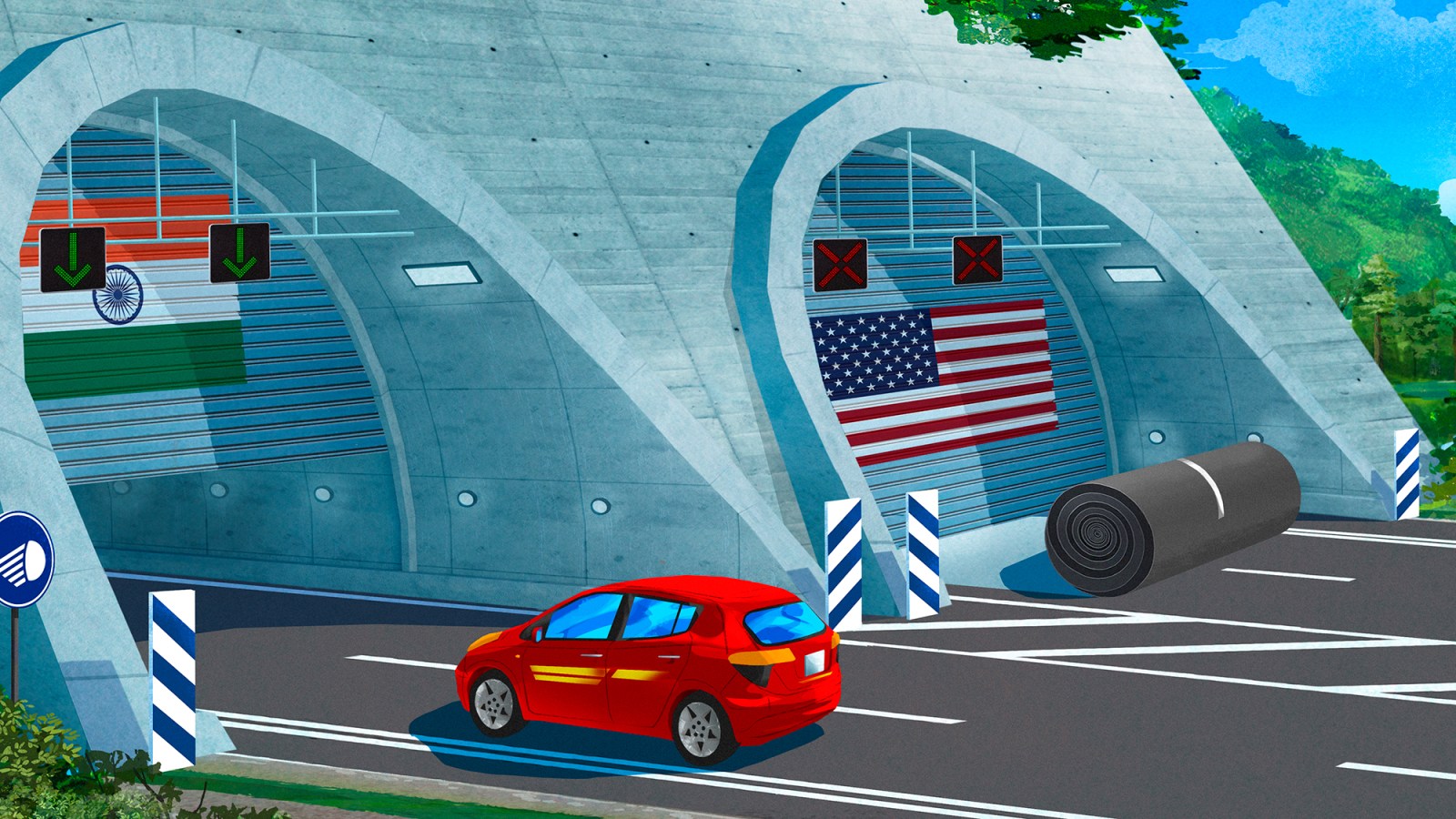

At a time when the US sets up trade barriers to keep Chinese EV giants at a distance, India has followed a different course.

“Without Chinese technology, India would have to deal with supply, delayed rollout and reduced product diversity,” Pragathi Darapaneni, Senior Battery Materials scientist and former researcher at Argonne National Laboratory, told Rest of World.

India's own EV makers are struggling while the government is renewing its subsidies to stimulate local innovation and investments. The country relies on Chinese technology to bridge the gap until the domestic players are more robust.

The shift is done without a fanfare. Since the deadly border clashes with China in 2020, forbidden India apps such as Tiktok and Shein and blocked Chinese car manufacturers such as BydBydBYD Auto is a Chinese car manufacturer who became the leading EV manufacturer in the world in 2023, competing with Tesla for market share and global attention.Read more From setting up a local factory, with reference to national security problems. Yet Chinese technology remains central to the EV ambitions of India. At the end of March India reduced rates at more than 35 EV components, most of which still come from China, making technology between the two countries even easier.

Large Indian EV-Makers, such as “Tata Motors, Mahindra & Mahindra, Ola Electric, etc., still trust Chinese suppliers for (Lithium-ion) cells and components of power electronics, even if the final meeting is done locally in India”, Shubham research, a Senior Analyst. Analyst.

“The goal is to build a resilient domestic ecosystem, not to isolate it, unlike the more aggressive decoupling that is seen in the US with China,” said Munde.

Indian companies opt for joint ventures with global players – mostly Chinese – to get both capital and shortcuts for R&D period lines. These partnerships help them “LeapFrog development phases by gaining access to tested EV platforms, battery modules and production books of production”, Leon Huang, CEO of Rapiddirect, a global precision production company that supports EV -Selexing Chains, said Rest of World.

Chinese companies “also help local partners (in India) build the reliability of the supply chain and achieve faster localization by starting with existing sub -libraries and production standards,” said Huang.

Such collaborations have shaken the Indian market. Tata Motors, the leading EV maker of the country, has seen his lead shrinking as a MG-Motor-a joint venture between the Indian conglomerate JSW and the Chinese car manufacturer Saic doubled his market share within a year. The MG Windsor, now the best -selling electric car from India, came from that collaboration.

In recent years, India has offered generous stimuli to car manufacturers to make EVs affordable, especially scooters and three -wheeled vehicles that dominate the roads. Yet only 7.6% of the new vehicles sold in India was electric in 2024, a slow pace for a country that strives for 30% electrification by 2030.

The new considering rules of the government for subsidies require companies to fully assemble EVs within India and at the same time allow the import of components that are not yet produced in their own country. Purchasing stimuli for consumers also shrink.

The revision has uncovered the vulnerability of the EV sector of India, with consumer financing 37% decreased from $ 934 million in 2022 to $ 586 million in 2024, and the EV sales begins to drop. The EV -fleet orders from Tata Motors fell from 26,000 in 2023 to only 2,000 vehicles in 2024.

Hero Electric, the first E-Scooter manufacturer from India, is confronted with bankruptcy procedure and is being investigated for non-compliance with the government's subsidy requirements; Extra-Mart, an EV-oriented Ride-Hailing Indian Startup, is closed; And the largest EV -maker in the country Ola Electric loses ground.

Bernstein Research estimates that four legacy car manufacturers control 80% of the Indian electric mobility market, while most 150 EV startups of the country 'struggle with losses'.

The EV market of India is expected to grow from 480,000 units in 2025 to more than 3 million units by 2035, according to a prediction of the data analysis company Globaldata, established in London.

The expansion requires a robust EV -Supply Chain, Vivek Kumar, an automotive project manager at Globaldata, told Rest of World. “India still faces considerable challenges. A shortage of technical expertise and an underdeveloped charging infrastructure continues to hinder progress,” said Kumar.

EV-related import is one of the most important contribution to the growing trade shortage of India with China, according to data from the Indian Ministry of Trade. Experts warn over -dependence on China could undermine India's goal to develop his own EV technology.

“India must be cautious that such partnerships do not lead to Chinese players dominating the market because this can reduce the stimuli for developing domestic companies and technologies. There must be a balance,” said Jason Altshuler, owner of My Electric Home, a provider in Colorado of innovative electrical solutions, including EV charders.

The opening of the market access to China is both a strategic and a safety risk for India. Chinese companies are confronted with intense research in India because of geopolitical rivalry. But New Delhi has avoided the curbs in the US on Chinese technology.

Tu Le, founder and director of the Mobility Intelligence and consultancy firm Sino Auto Insights based in Detroit, sees the tariff war of US President Donald Trump against Chinese EV components-in particular batteries-and an obstacle to the EV growth of America. Le said the rest of the world that the US has lost the EV -Momentum over the years, and Trump's EV policy “guarantees that the US will not go further about continuous EV sales.”

India opts for soft protectionism and strives to “integrate – not insulating – Chinese supply chains until the substitutes are mature,” said Munde.