Bevs represented in May close to a third of the total Chinese car market.

May saw the continuation of the endless growth of the Chinese EV market, where plug-ins scored more than a million turnover in May (in a general market of 1.9 million unit).

Honors were deeper in the number and were the fastest growing technology and rose by 52% to 116,000 units, or 11% of the plug -in revenue -while PHEVs grew 32% JOJ (29% share of plug -ins) and Beels grew by 23% (59% share of plugins).

This draws the year-to-date (YTD) count to more than 4.3 million units. So we would have to see Plug -Ins the year then see 10 million units ending – in China alone….

In terms of share, May Saw Plugin Vehicles that reach 53%! Full Electrics (bece) alone accounted for 31% of the total automatic sale of the country.

This good result in May attracted the 2025 share to 49%. Bevs were stable in itself, with 30%. Expect to see Plug -Eins at 50% and BEVs at around 31% at the end of June.

(Can China end the year above 60%?)

A quick glance at the export numbers, in May there were 200,000 units, an increase of 81%, and interesting is that 53%of the domestic market was electric, when it comes to export, the EV component was smaller, by 45%. So it seems that China exports a larger part of the stinkers compared to EVs than it sells on its domestic market.

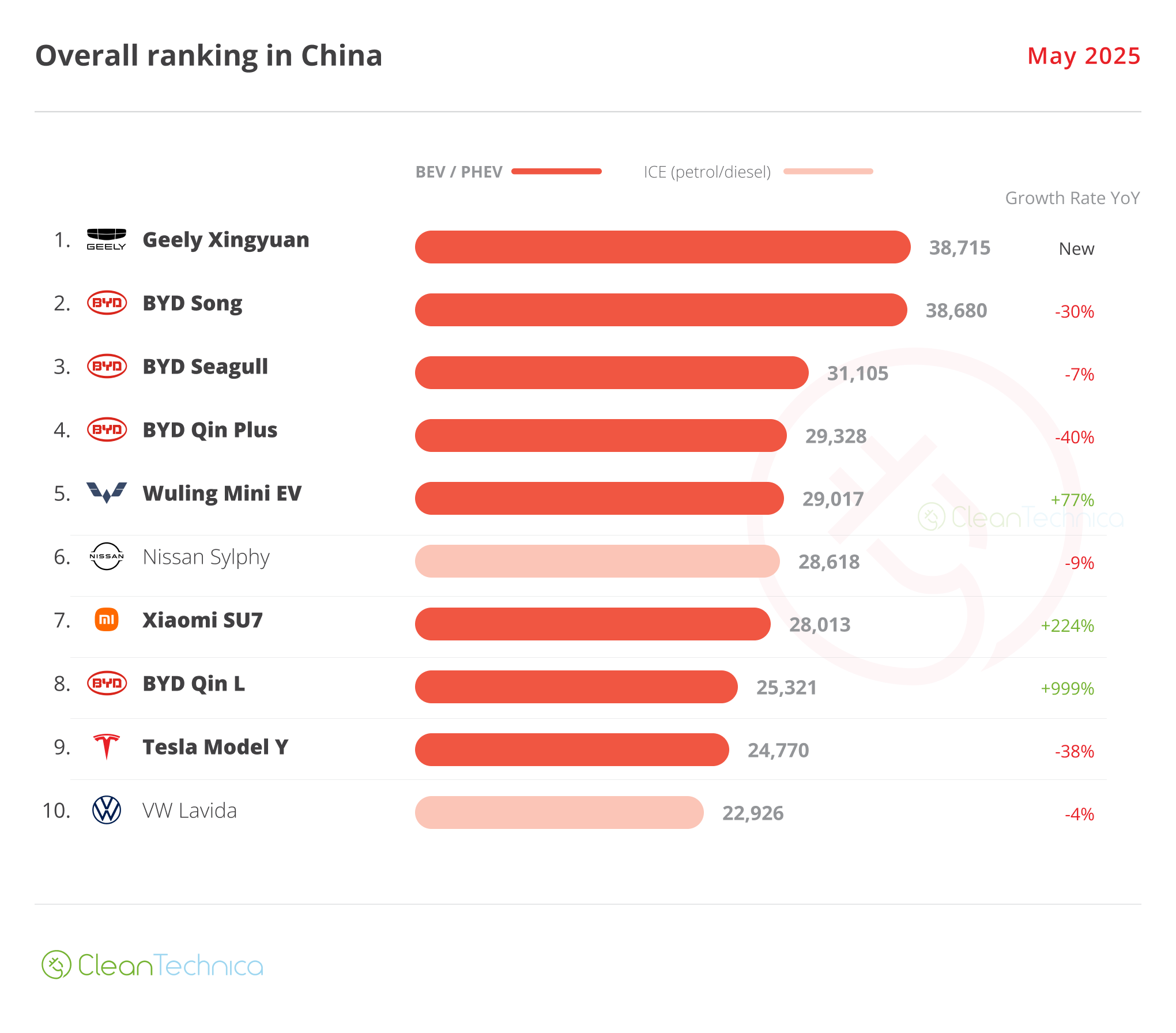

In the overall ranking, completely with fossil -powered models only had two representatives, with the best placed the Nissan Sylphy in 6th.

When do we see a top 10 made of plug -in? June? Or should we wait for the second half of the year?

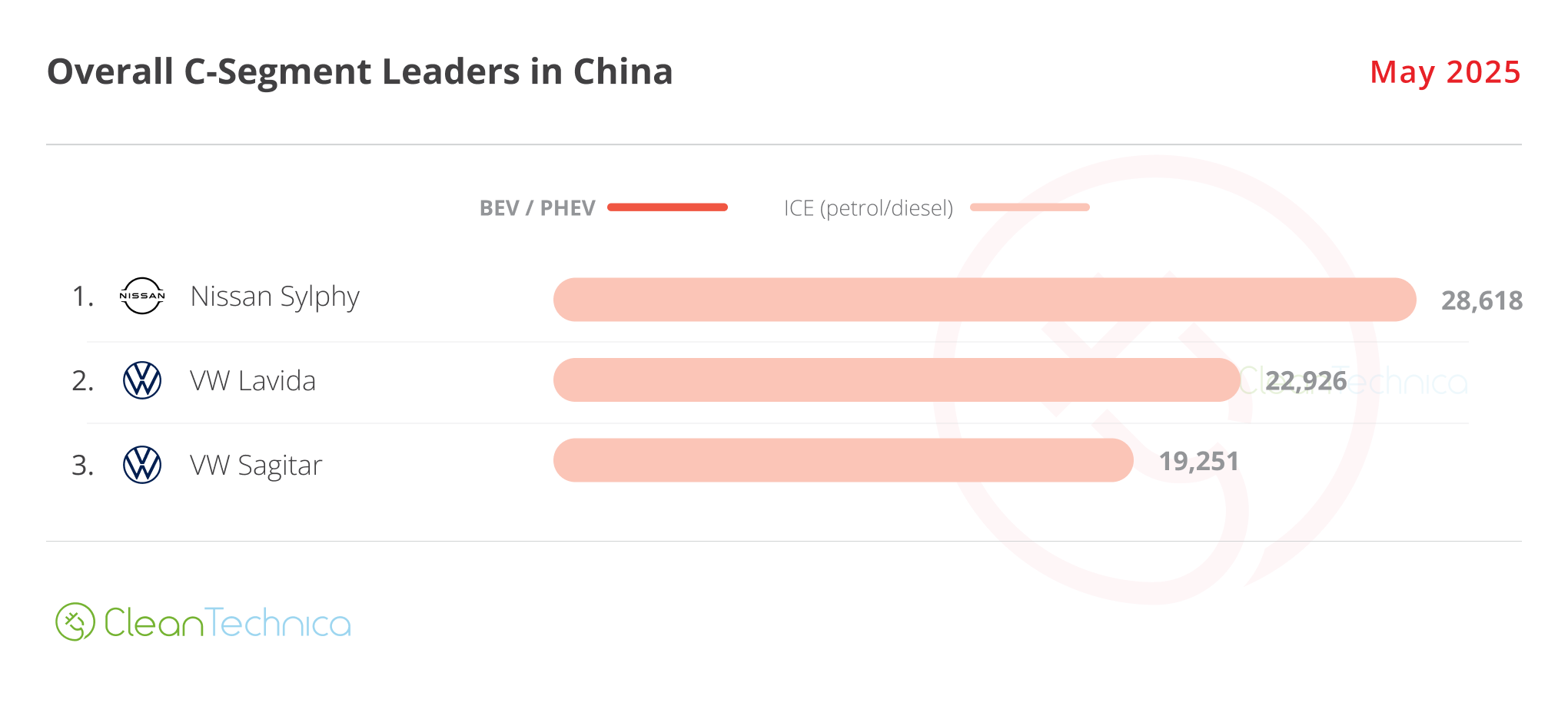

Looking at the bestsellers in different size categories, all C segment (compact cars) plug -ins first. In fact, the C segment saw a 100% ice (internal combustion engine) stage, nowadays a rarity.

In all other categories they were absent or the minority. This is a recurring subject, because it seems that the C segment is the most difficult to convert in EVs. Looking at the positive side of this, this means that models such as the Xpeng Mona M03, BYD Sealion 05 and Geely Galaxy E5 have enough space to grow.

The biggest surprise was the 100% BYD stage in the medium -sized category, an achievement in itself. Byd alone has 10 medium -sized models in the line -up.

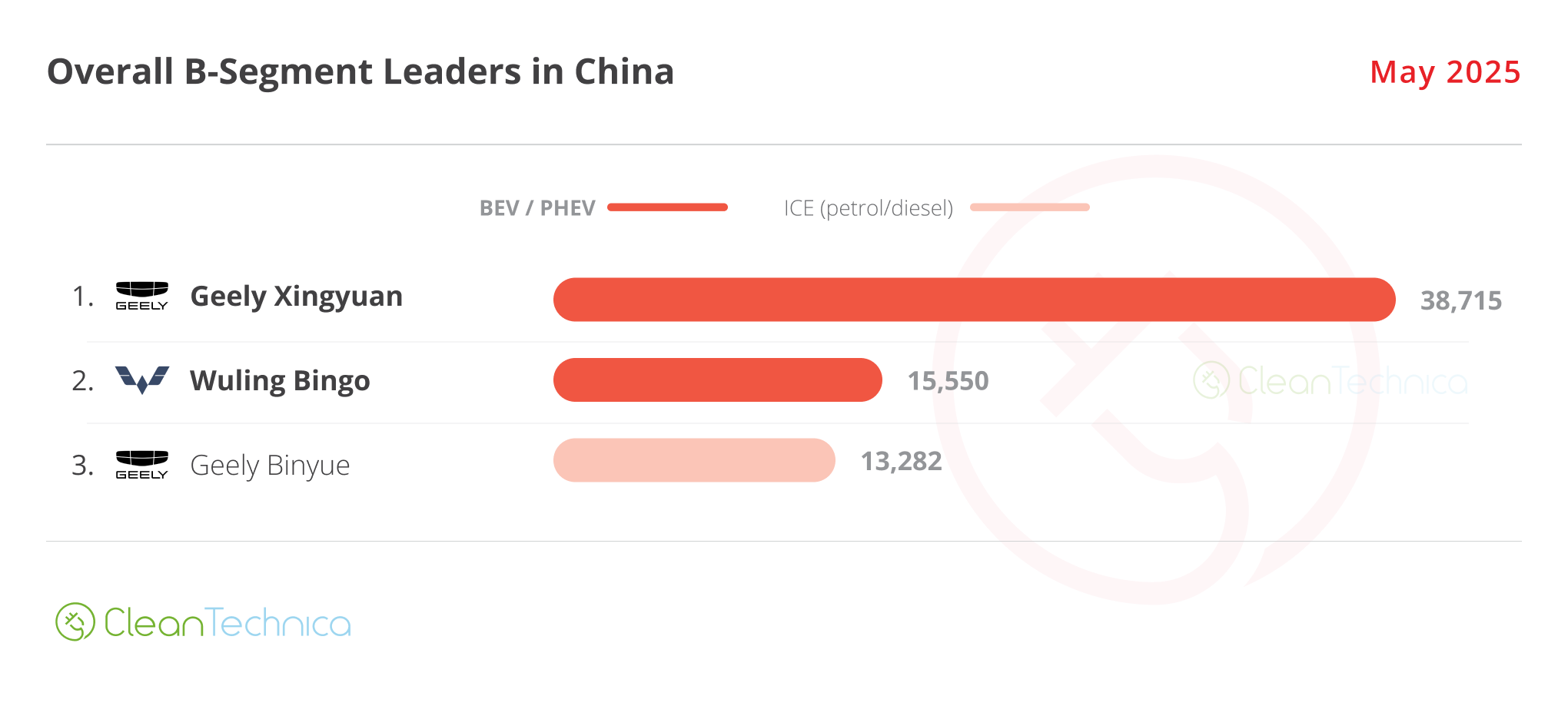

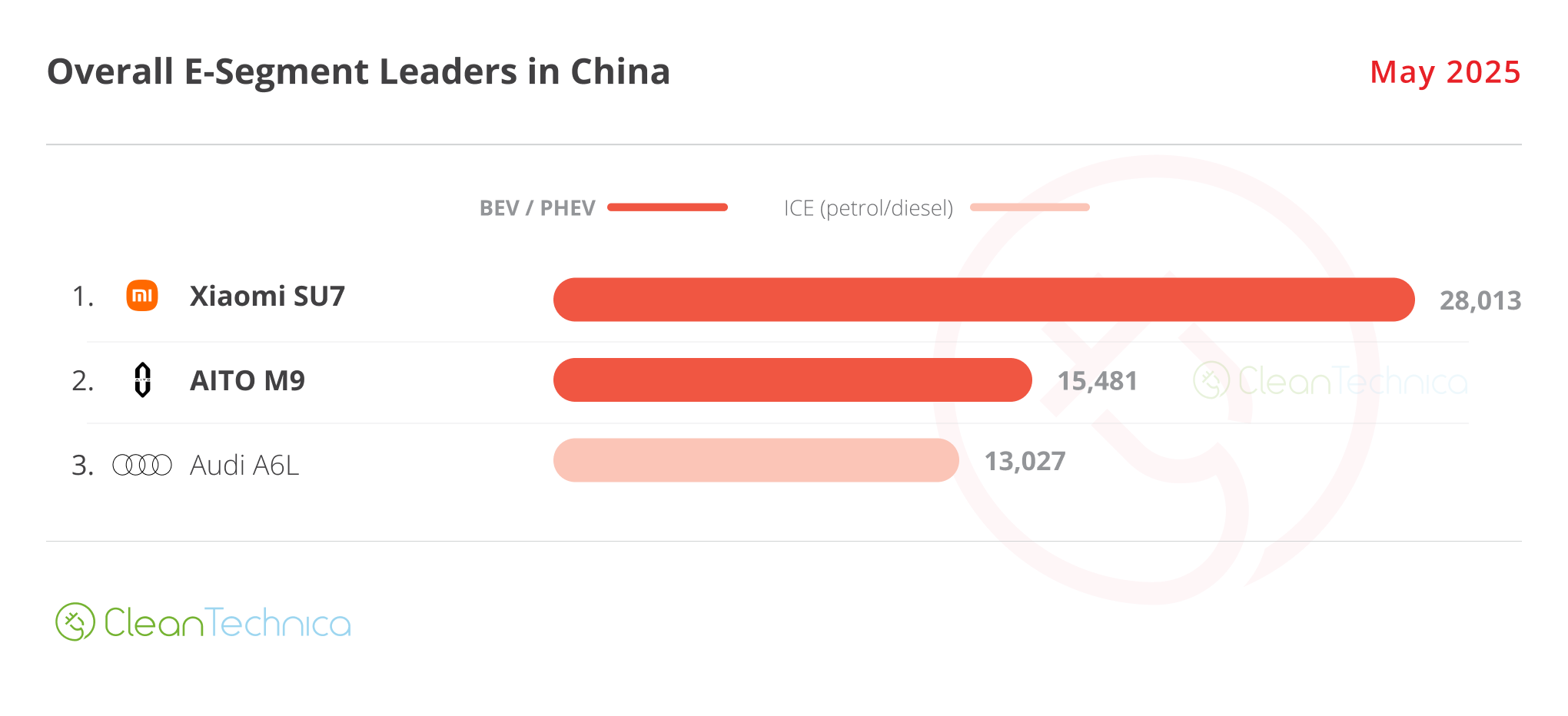

Another topic to emphasize is the domination that the Geely Xingyuan and Xiaomi SU7 have in their respective categories, with the small hatchback and the Sportsedan that doubles the sale of their second models category.

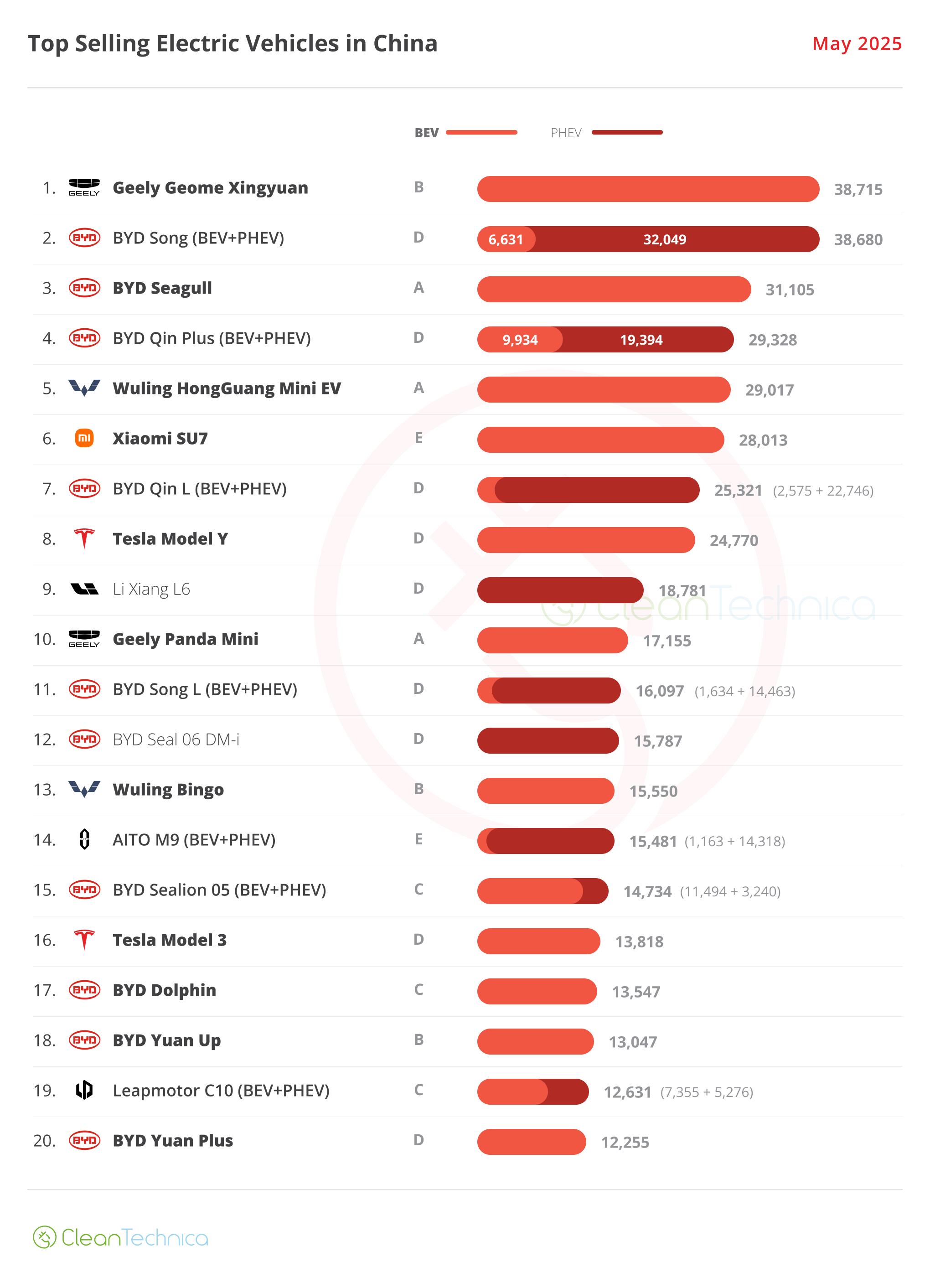

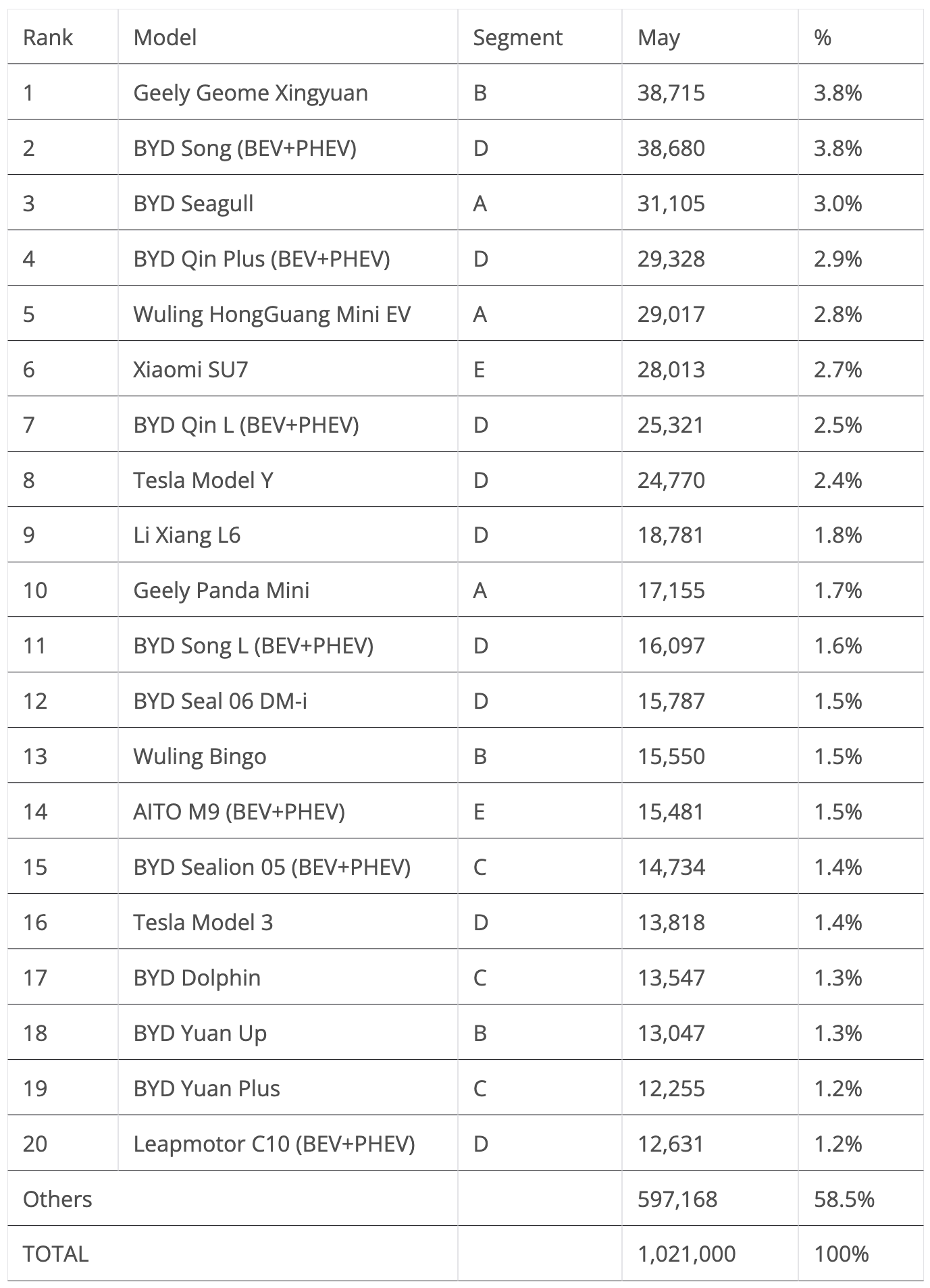

Here is more info and comments on the best -selling electric models of May:

#1 – Geome Geome Xingyuan

Geely has cracked the code. The Xingyuan left the make to beat BYD … as well as the rest of the competition. In May the Kleine Hatchback won his second consecutive bestseller trophy in China. In addition to the murderous price, all the support that comes from a leading OEM such as Geely does not hurt, as well as a rounded, sensible design – somewhere between a Wuling -Bingo and a smart #3. Starting with a price of 80,000 CNY (+/-$ 11,000), the buyer gets a 30 kWh LFP battery from Catl, which is nothing to write home until you realize that the price is closer to the BYD-Zeemeeuw (70,000 CNY for the 30 kWh version) then places the BYD Dolphin (100,000 CNY). In May the Geely model reached 38,715 registrations, the fifth record score in a row. Export? That is certainly in the cards. But first Geely will end the production to satisfy its own internal market.

#2 – Song World (BEV+PHEV)

BYD's medium -sized SUV lost its bestseller status and scored 38,680 registrations, a steep drop of 30%. It seems that the veteran model (six years is an eternity in China) is close to its expiry date in its domestic automobile market, so although the title of the bestseller of 2025 is still a strong opportunity, 2026 should see the septre pass on to another model. A competitive price can only bring you so far, and with an ever -competitive market, BYD's medium -sized SUV will need a significant improvement if it wants to continue to clock 40,000+ sales/month, a necessary threshold to continue to lead the Chinese car market of the murderer.

#3 – Byd Seamull

De Kleine EV caused a different presence of stage thanks to 31,105 registrations, a drop of 7%. Because part of the production is now being diverted to export markets, it seems that the demand for the Kleine Lambo is now at cruising speed in China. The Parmante EV is now stage -friendly. Even with his attention now diverted to other regions, such as Latin America, Asia-Pacific and Europe, the Kleine BYD expects to continue to be part of the BYD package that fills the Chinese top 10.

#4 – Byd Qin Plus (BEV+PHEV)

The old dog came to the top 5 in April, thanks to 29,328 registrations last month, a steep drop of 40%. Yet that meant that it was the best -selling sedan in China, all driven powertrains. The 7-year-old body may show a few wrinkles, but the low prices still offer a considerable demand for the medium-sized sedan. Question is – how long?

#5 – Wuling Mini EV

The 2021 best-selling EV in China is in shape again, thanks to a renewal and above all a new 5-door version. This allowed the small city car to reach 29,017 registrations in May, an increase of 77%. So it seems that the little EV is back to his good old days. With the price of the 5-door version from 45,000 CNY ($ 6,200), it remains one of the cheapest in its category. And this time it is not too bare bones, because it has a 16 kWh LFP battery, supports DC chargers and contains things such as air conditioning and remote control via mobile phone.

Looking at the rest of the bestseller table, the highlights come from the second half of the table, whereby the Aito M9 jumps to #14, while the BYD Sealion 05 benefits from the production-ride of his BEV variant to reach the 15th position.

At the bottom we have the Leap engine C10, which came to the table for the first time at #20 and emphasizes the strong moment that the true is experiencing money for starting up.

Outside the top 20 we had a few recent models that solve production.

Starting with the BYD stable, the Tang L collected strong 7.004 registrations, the Seal 05 had 7,631 registrations, while the more chic Fangchengbao Tai 3 compact SUV had 5,598 registrations in May.

Elsewhere we have to emphasize the disaster up of the Avatr 06 medium-sized sedan, where we score a significant 6,368 registrations. This could be a good sign for Changan's premium brand, which has had difficulty finding success with his earlier models. Still about Changan's stable, more precisely the Qiyuan -Line -Up, had the new Q07 -sized SUV 8,081 registrations on the market in just the second month.

As for the Geely stable, there are also a few models in the disaster-up mode. The Geely Starshine 8 flagship Sedan delivered 10,187 units on the market in the first full month. It seems that the new MEMEL MODEL can be the top 20 of material. The other EV that comes from Geely Holding is the Lynk & Co 900, which reached 5,593 registrations.

Finally, a few entries go to the new Aito M8, a less flashy version of the M9 Full Size SUV, which reached 12,116 registrations in just the second month on the market. Shall we see two Aito models on the table soon?

Incidentally, the same could happen to the jump engine, because not only the C10 came to the table in May, but the new B10 compact crossover rises and 10,105 units reached. So we may see two Leap -Motor models on the Bestseller table.

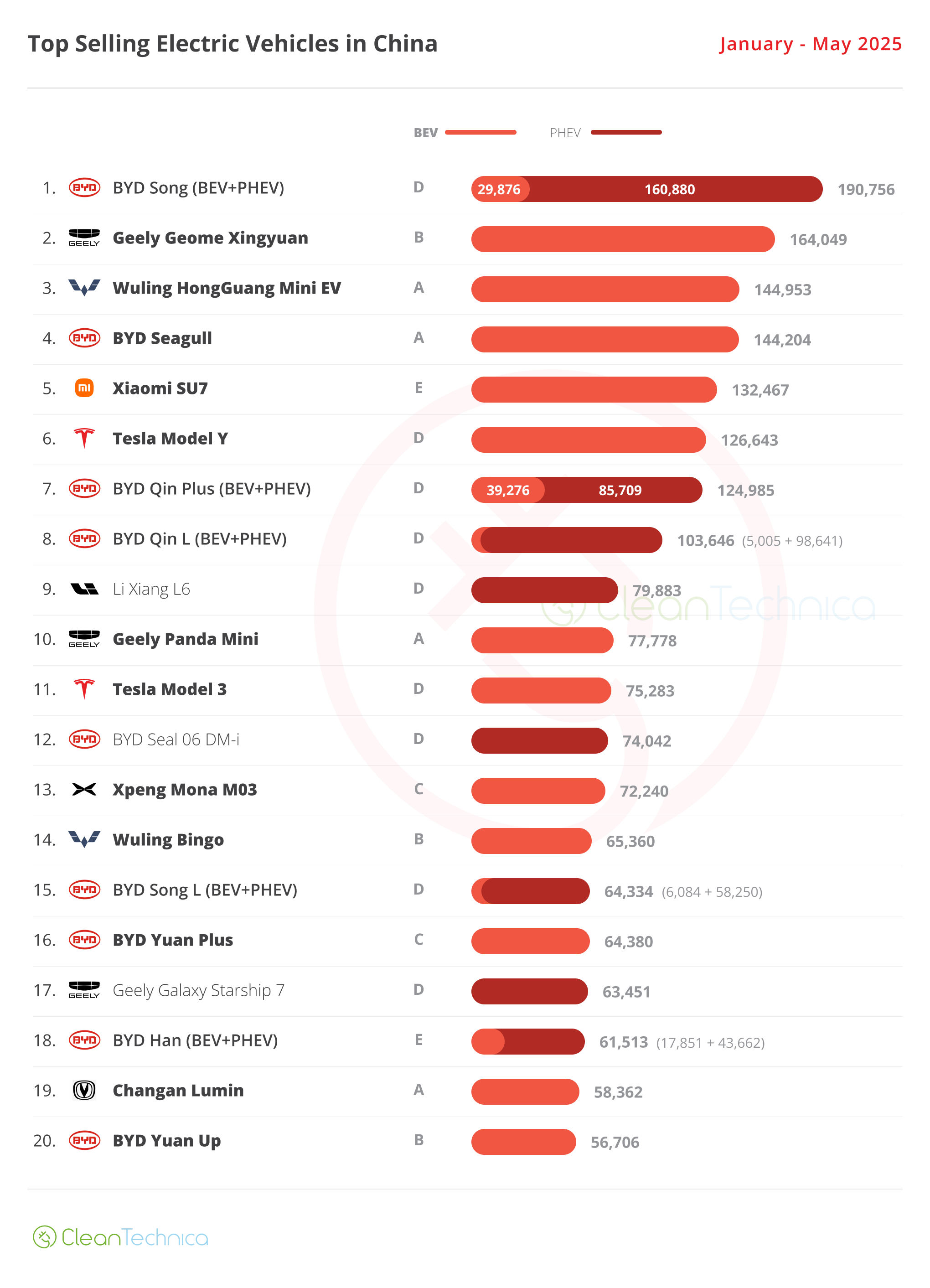

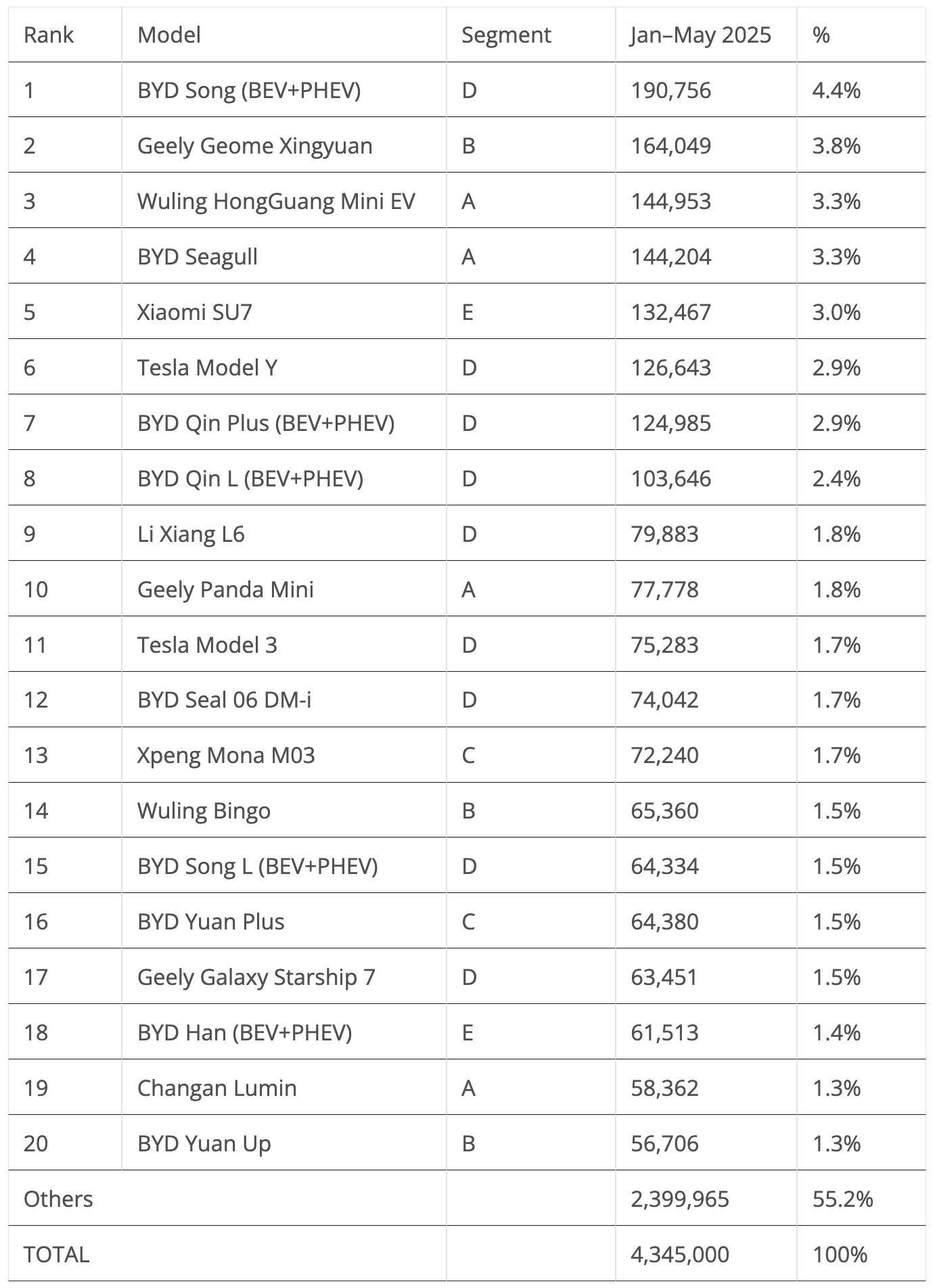

The 20 best selling electric vehicles in China – January – May 2024

Looking at the ranking of 2025, the most important highlights were the Li L6 and GEYY Panda Mini who jump two positions, respectively to 9th and 10th. The two models benefited from a slow sale of the Tesla Model 3 and Xpeng Mona M03 to go on the ranking.

Furthermore, below the #14 Wuling Bingo and #15 BYD Song L each jumped three positions. We also have to take a good look at how the number L behaves, because the medium-sized SUV is effectively the 2nd generation number. It has a number of large shoes to fill, given all the trophies collected by the first generation.

Now let's look at the best -selling EV -brands and car groups.

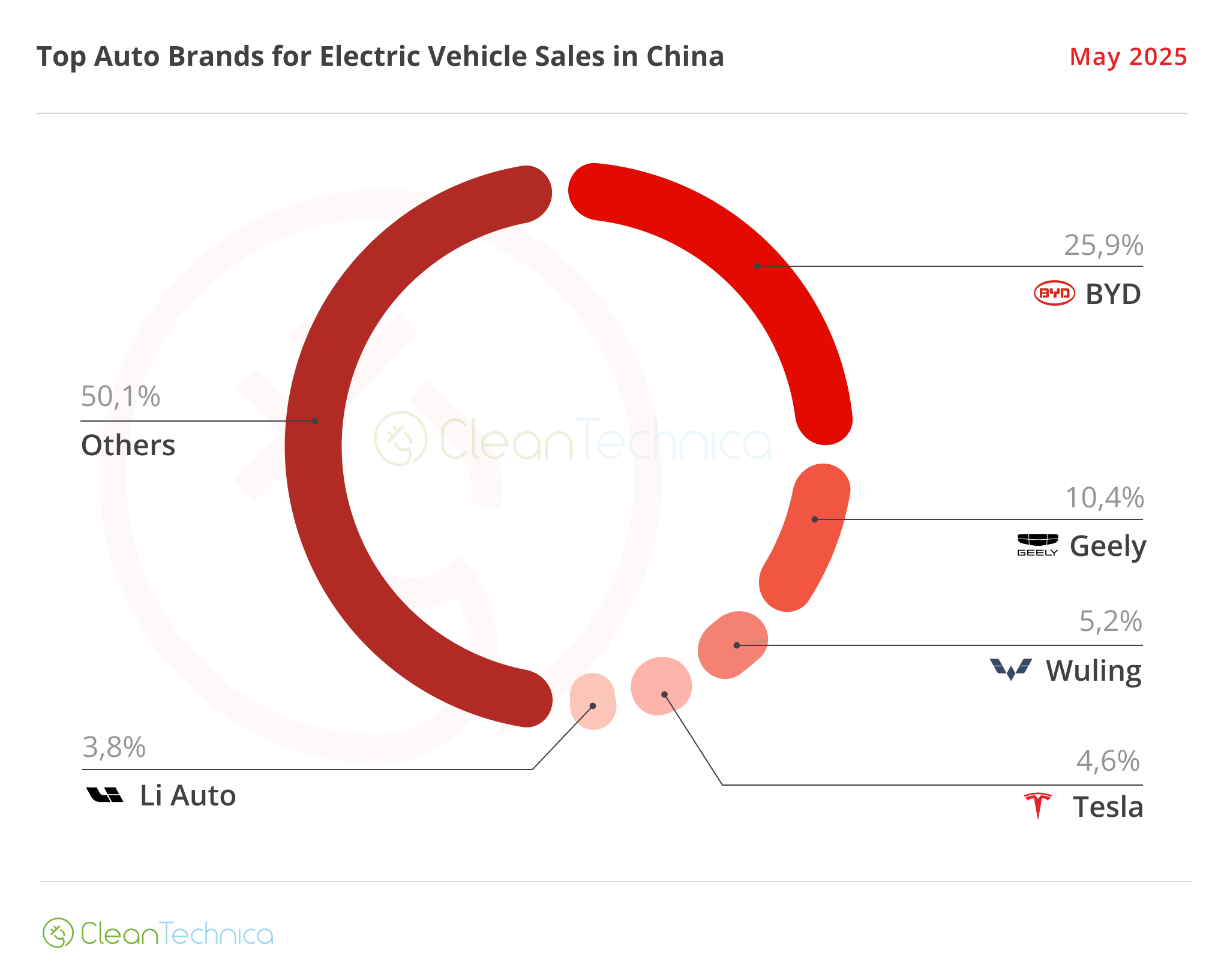

Car brands sell most electric vehicles in China

Looking at the ranking of car fire for plug -in vehicles, there is not much news. BYD (25.9%, a decrease of 26.2%) remains as stable in its leading position as always.

Despite losing share, it is the same story with Geely (10.4%, a decrease of 0.1% in May), with the brand -standing company in second place.

Things become more interesting below. Wuling (5.2%, compared to 5.4% in May) remained in 3rd place and won some distance over Tesla, who lost even more share (now 4.6% versus 4.9% in May).

In a normal timeline this would mean that Tesla would certainly surpass in June, but because we are in an alternative timeline, the task of Tesla is now more difficult. So it would not surprise me if Tesla could not reach the stage of the Chinese EV manufacturer -table for the first time since 2019.

Elsewhere #5 Li Auto (3.8%) achieved some land over the two above it, while Xpeng (3.4%, a decrease of 0.1%) lost a position of jump engine (3.6%now, an increase of 3.3%in April), with this startup now threatening #5 Li car. So, June can take a new leader with you in the Chinese startup race.

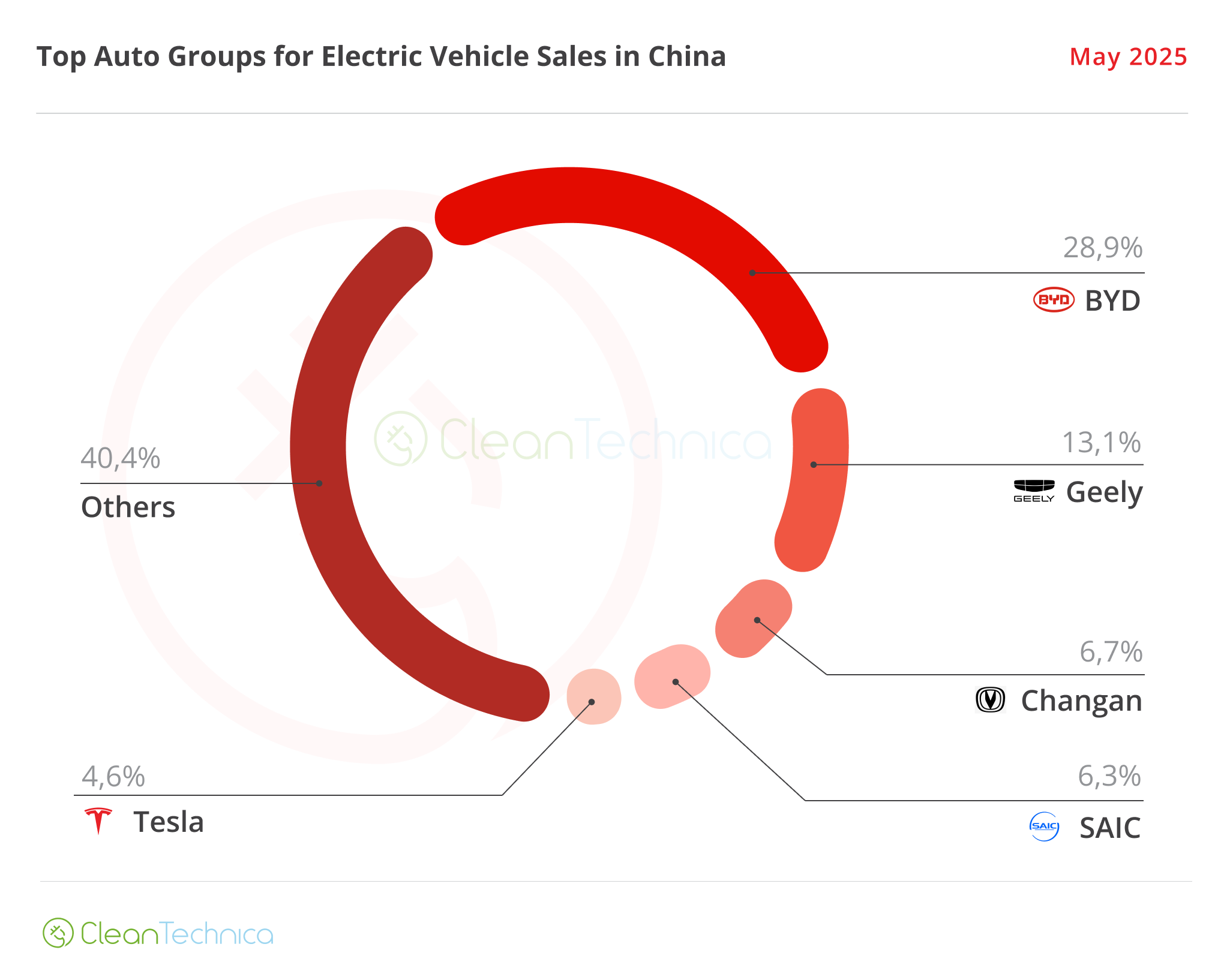

Car groups that sell most electric vehicles in China

Looking at OEMs/automotive groups/alliances, BYD is comfortable prominent, with 28.9% share of the market, which benefits from positive performance by Denza and Fangchengbao, while Gene is a distant second with a 13.1% share.

Far from number two there was a change in position in 3rd place. Changan (6.7%, an increase of 0.2%) benefited from good performance from his daughter Brands Avatr and Qiyuan, while Saic continued to fall (6.1%, a decrease of 0.2%).

Tesla (4.6%) remained in the 5th, but Tesla's 2024 3rd place on the OEM order seems almost impossible to reach, and it could even be the case that there will be no Tesla in this top 5 at the end of the year, because #6 Chery (4.4%) could surpass it in the coming months.

Sign up for the weekly substitue of Cleantechnica for the in -depth analyzes of Zach and Scott and Summaries at a high level, sign up for our daily newsletter and follow us on Google News!

Whether you have solar energy or not, fill in our latest Solar Power Survey.

Do you have a tip for Cleantechnica? Do you want to advertise? Do you want to introduce a guest for our Cleantech Talk -Podcast? Contact us here.

Register for our daily newsletter for 15 new Cleantech stories per day. Or sign up for our weekly stories of the week if daily is too frequent.

Advertisement

Cleantechnica uses Affiliatielinks. See our policy here.

Cleantechnica's commentary policy